Tech moves fast—stay faster.

Tech moves fast—stay faster.

London’s Luxury Property Market Faces Sharp Decline as Demand Wanes

By Farhan Ali • June 23, 2025

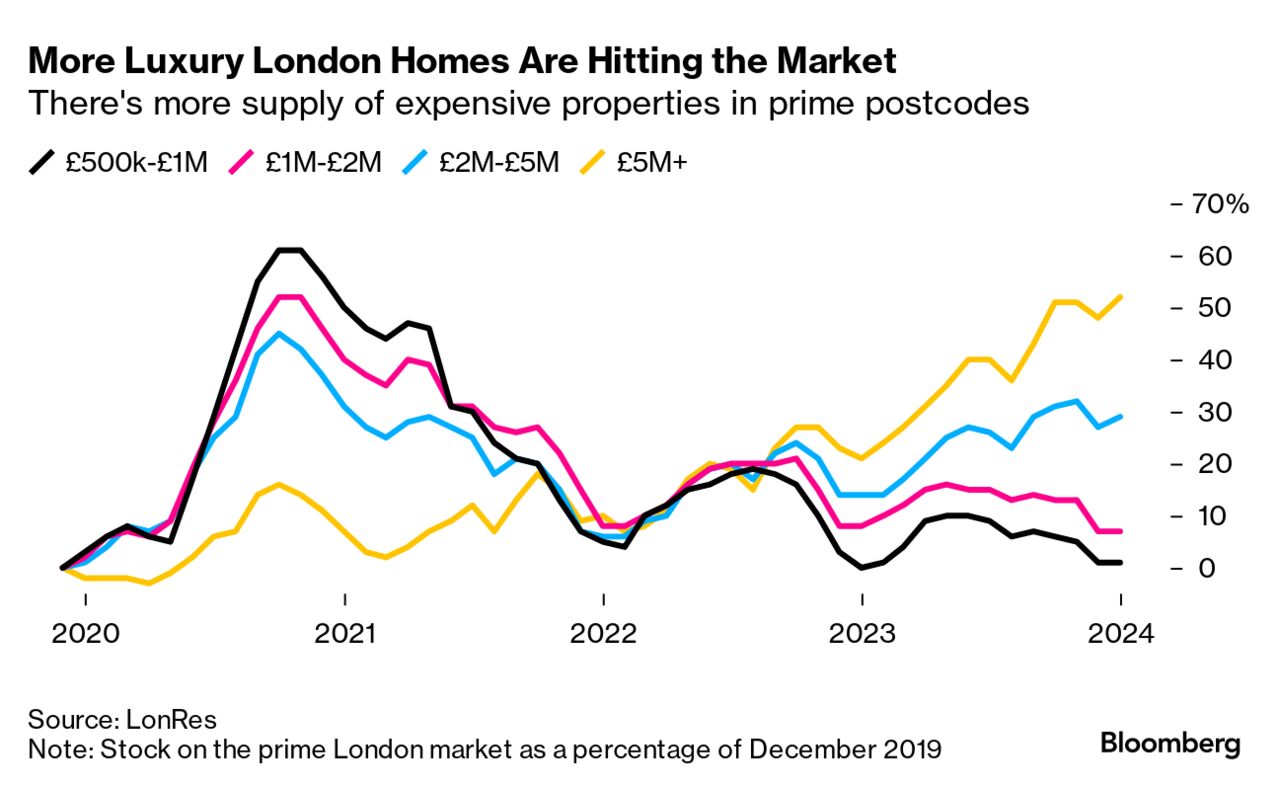

London’s luxury real estate market—once considered a fortress for global investors—is entering a phase of extended correction. New data shows a surge in unsold inventory, price cuts across major districts, and a marked decline in international buyer activity, all signaling deeper trouble for the city’s top-tier properties.

What’s Happening

Across neighborhoods like Chelsea, Knightsbridge, and Mayfair, properties listed above £5 million are taking twice as long to sell compared to this time last year. Developers are now offering incentives, while long-standing owners are being forced to slash prices by as much as 15–20% just to generate interest.

Key Trends Driving the Decline:

- Interest Rate Pressure: UK base rates remain elevated, reducing the borrowing capacity for even affluent buyers.

- Foreign Buyer Retreat: Stricter regulations and geopolitical uncertainty have slowed international capital inflow, particularly from China, Russia, and the Middle East.

- Shift in Priorities: Post-pandemic, buyers are less focused on pied-à-terre investments and more on flexibility, remote lifestyles, and secondary markets outside major metros.

Market Commentary

Real estate analysts argue that the downturn may be less of a crash and more of a healthy recalibration. Over the past decade, London’s prime property prices surged disproportionately, pricing out even high-net-worth individuals. The current correction, they argue, could open the door for longer-term sustainability.

Investor Sentiment

While some investors are exiting the market altogether, others view this as a buying opportunity. “Every major slowdown in prime London over the past 50 years has led to 3–5 years of record growth,” notes Igor Griskin, a London-based wealth advisor.

Still, the broader tone remains cautious, especially as political shifts, global inflation, and market regulation continue to shape economic behavior heading into 2026.

Conclusion

The fall of London’s luxury property market isn’t sudden—but it is significant. Once the hallmark of global prestige real estate, the capital’s high-end housing now faces an uncertain future. Whether this correction stabilizes or worsens depends on how quickly the city can adapt to a new economic reality.

Additional References:

- Bloomberg Business (@bloombergbusiness)

- Financial Times (@financialtimes)

- UK Housing Market Updates (@ukhousingmarket)

- Property Week (@propertyweek)

- Luxury Property London (@luxurypropertylondon)

Explore more

From Solo IP to Shared Ecosystems: Partnered Innovation Becomes the New Business Default

By farhan Ali • June 23, 2025 A quiet revolution is happening...

Rajasthan’s iSTART Program Funds 800+ Startups, Creates 40,000+ Jobs in Inclusive Innovation Push

By Farhan Ali • June 23, 2025 India’s startup revolution is no...

Five Bidders in the Race to Acquire PIA as Pakistan Advances Major Privatization Drive

By Farhan Ali • June 23, 2025 Pakistan’s federal government has shortlisted...

Immortal AI Unveils Three New Platforms to Transform African Market Intelligence

By Evolution Staff • June 23, 2025 Immortal AI, a Lagos-based AI...

Leave a comment