Tech moves fast—stay faster.

Tech moves fast—stay faster.

Switzerland Cuts Interest Rate to 0%—What It Means for Europe and the Global Economy

By Evolution Staff • June 23, 2025

The Swiss National Bank (SNB) has taken a historic step by reducing its benchmark interest rate to 0%, ushering in a new phase of ultra-accommodative monetary policy. The cut, which came on June 19, 2025, lowered rates by 25 basis points and comes amid signs of easing inflation and concerns over slowing growth.

Market Reaction

The rate decision was largely anticipated. Traders had priced in an 81% probability of a 25-basis-point cut, according to Bloomberg analytics, with a 19% chance assigned to a deeper 50-point cut. Following the announcement, the Swiss franc weakened slightly against the euro, and bond yields dipped across the board as investors recalibrated expectations.

Why the Cut Now?

According to the SNB, “Inflationary pressure has decreased compared to the previous quarter. With today’s easing of monetary policy, the SNB is countering the lower inflationary pressure.” The bank’s cautious wording signals a desire to maintain flexibility should deflation risks resurface or external shocks arise.

Switzerland’s inflation rate is currently at 1.3%, well below the EU average and within the SNB’s comfort zone of 0–2%. Analysts say this policy space allowed the central bank to act preemptively without destabilizing its inflation outlook.

Implications for Switzerland and Beyond

- Domestic Borrowing: Cheaper credit could encourage consumer lending, home loans, and SME financing.

- Property Markets: The move may fuel already tight real estate markets, especially in urban cantons.

- European Policy Signals: As the European Central Bank (ECB) considers its next move, Switzerland’s decision may influence sentiment in surrounding economies, especially those facing stagnation.

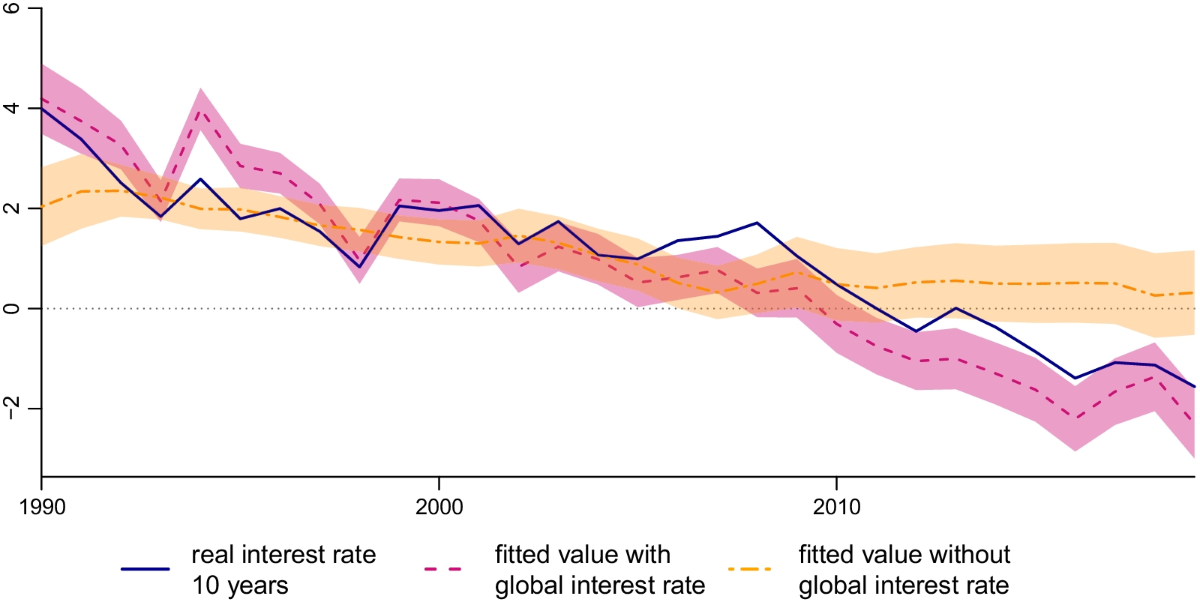

- Return to Negative Rates? Economists warn that any prolonged global downturn could push Switzerland back into negative-rate territory, as seen between 2015–2022.

Investor Sentiment

While zero rates are rare globally in 2025, Switzerland’s unique macroeconomic profile—low debt, low inflation, and high reserves—allows more flexibility than most. However, sustained 0% rates could also weaken the banking sector’s margins over time and encourage capital outflows to higher-yield markets.

Conclusion

Switzerland’s pivot to zero interest rates represents more than a technical adjustment—it’s a strategic gamble on stable inflation and moderate growth. For global markets, it’s a signal that the post-inflation era may be transitioning into an ultra-stable, low-yield landscape. As investors and policymakers alike watch closely, the Swiss model could once again shape the future of European finance.

Additional References:

- CNBC International (@cnbcinternational)

- Bloomberg Business (@bloombergbusiness)

- Reuters Economics (@reuters)

- Financial Times (@financialtimes)

- Swiss National Bank Official Site (snb.ch)

Explore more

Yiren Digital and Innodata Lead June’s AI Stock Picks as Investor Attention Shifts to Niche Enablers

By Farhan Ali • June 23, 2025 With Big Tech AI stocks...

Pakistan Finalizes $4.5 Billion Islamic Finance Deal to Resolve Power Sector Debt Crisis

By Farhan Ali• June 23, 2025 Pakistan has taken a major step...

Singapore Dollar Could Match U.S. Dollar in Our Lifetime, Says Bank of Singapore Economist

By Farhan Ali • June 23, 2025 A major shift may be...

Kenya Expands Bank Transfer Hours with KEPSS Upgrade, Eyes 24/7 Real-Time Settlement

By Farhan Ali • June 23, 2025 Starting July 1, 2025, Kenya’s...

Leave a comment